HMRC requires most sole traders and landlords to keep business records, and prepare and submit Income Tax Self Assessment tax returns.

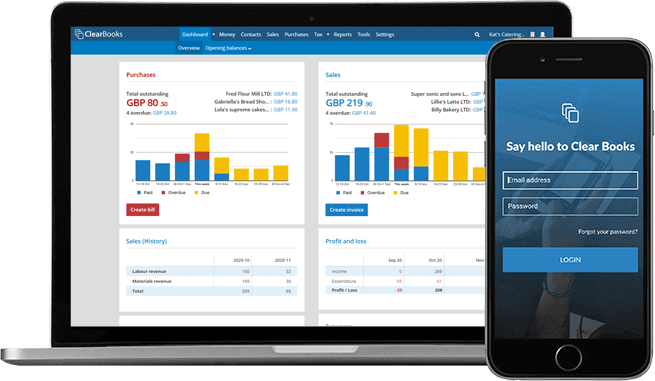

Our easy-to-use software can help you to effortlessly comply with these rules and stay on top of your business' income, expenses, and tax position. Clear Books makes it simple for you to track and manage your financial records, giving you peace of mind and more time to focus on running your business.

Be ready for Making Tax Digital for Income Tax with Clear Books.

Be confident you comply with HMRC rules, including filing your MTD for Income Tax quarterly updates. Clear Books is recognised by HMRC as Making Tax Digital ready software.

We are listed on the HMRC's Making Tax Digital software list, and help thousands of sole traders and landlords each month.

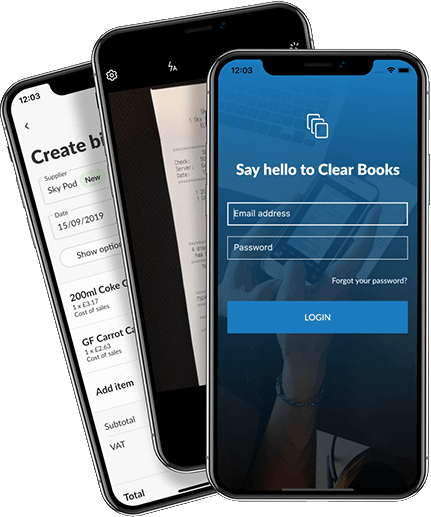

Never lose a receipt or forget to record your income, with Clear Books software. With our award-winning software and mobile app, you can confidently track all your taxable income and allowable deductions.

We help thousands of small businesses stay on top of their Self Assessment needs every year.

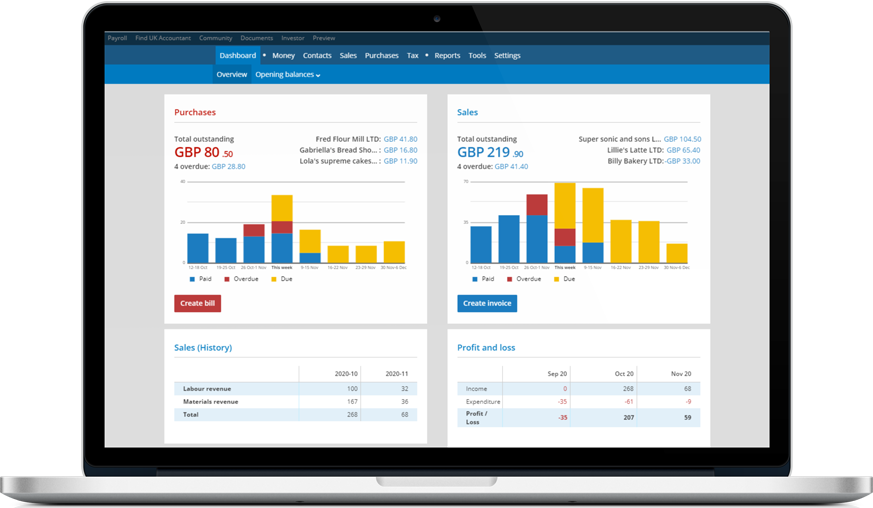

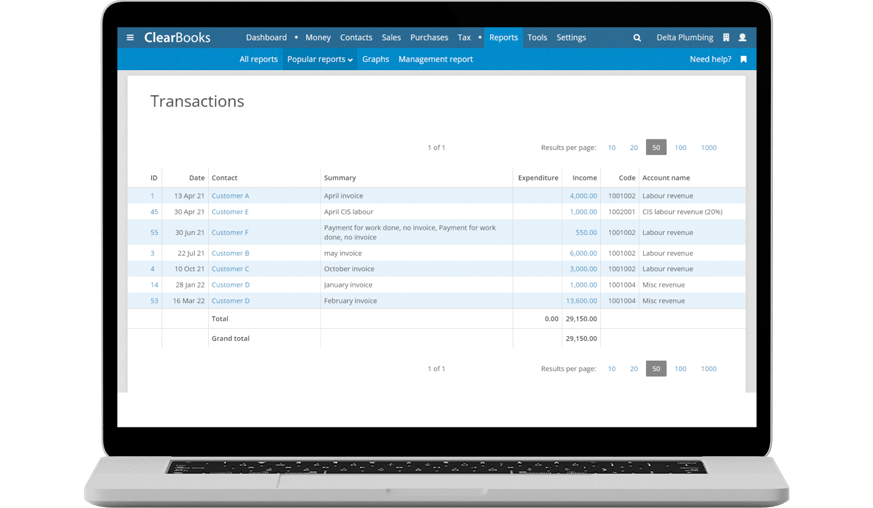

Clear Books is designed to fit seamlessly into your workflow. Whether you raise invoices or track payments from your bank account, our software makes it easy to manage your business's financial records.

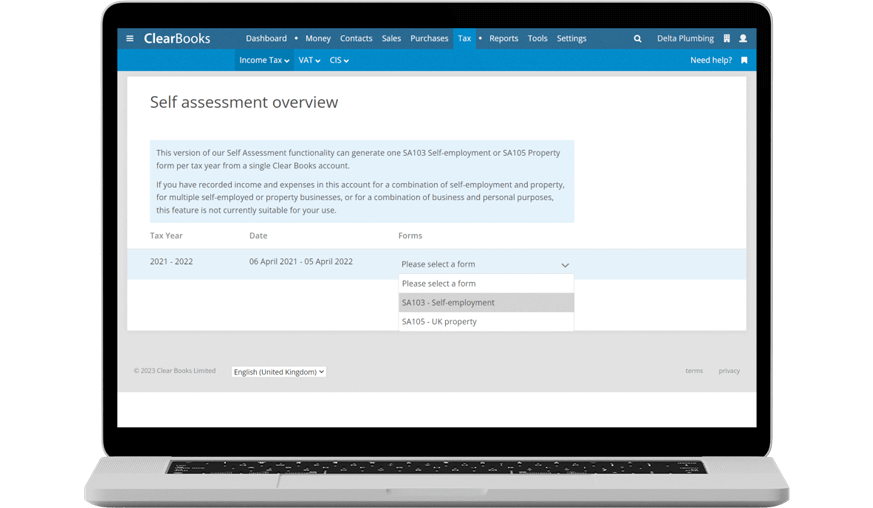

All sales are automatically calculated in your Self Assessment return, to save you a lot of extra work.

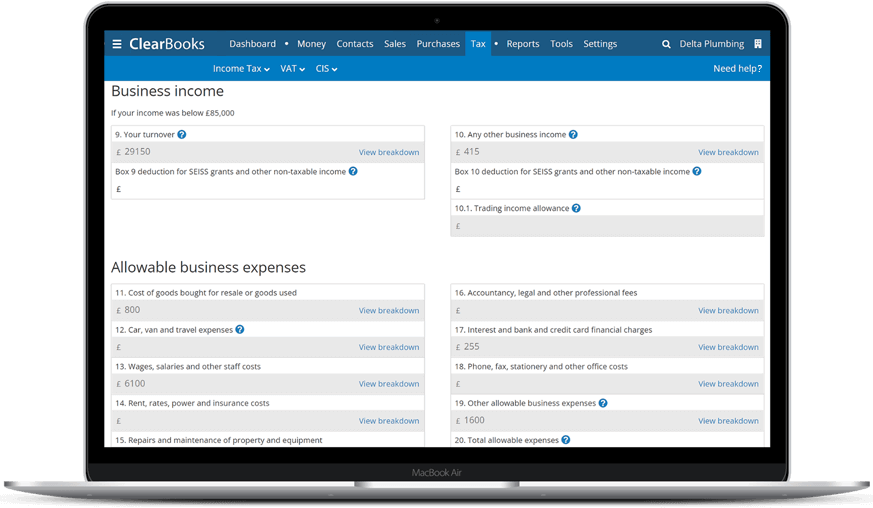

Track your purchases to claim your tax deductions. Simply take photos of receipts with the Clear Books app, and our software will automatically read the text in the photo, creating a record for you to review and save, meaning no more tedious manual entry.

If you want to track bills manually to claim those deductions, you also have the option to type them in, using our easy 'bills' form.

Clear Books calculates and displays an estimate of your sole trader or property income tax based on what you've entered into the software, to help you review your possible tax position.

And, if you want more detailed reports, Clear Books will automatically generate popular reports for you to review and analyse.

You don't need an accountant, as you can submit your quarterly updates from within Clear Books yourself. If you're not confident with your end-of-year tax filing, you may want help from an accountant for that.

In a word, no. There are no penalties from HMRC related to the accuracy of the quarterly updates, but there are deadlines by which the updates must be submitted. Using Clear Books will make it easier to submit quarterly updates on time, and help improve the accuracy of them, too.

No. MTD quarterly updates don't trigger a tax liability - but they do give you better visibility into what your tax might be at the end of the year.

Clear Books, accredited by The Institute of Certified Bookkeepers and registered with the Financial Conduct Authority (reg. no. 843585), delivers valued, comprehensive online accounting software for small businesses in the UK.