CIS software, CIS deductions, CIS payroll, CIS statements, CIS bookkeeping, CIS invoices. CIS explained simply for companies & businesses in the construction industry.

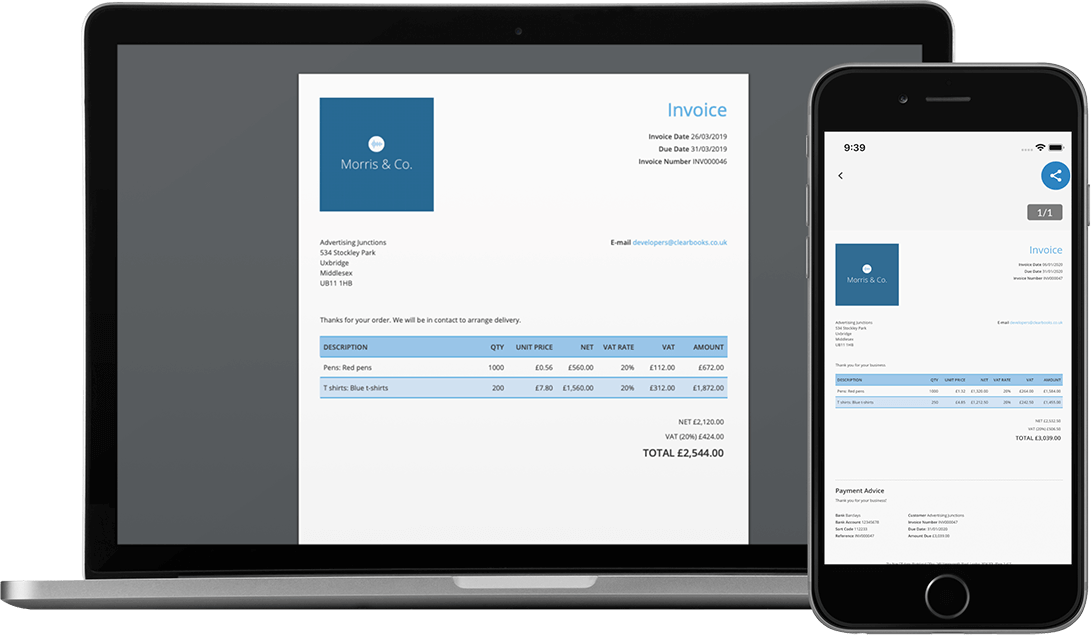

With Clear Books, it's easy to create and send CIS compliant quotes and invoices. You can include your UTR and your CIS deduction rate on each invoice.

Clear Books will automatically calculate the CIS deduction that should be made by contractors.

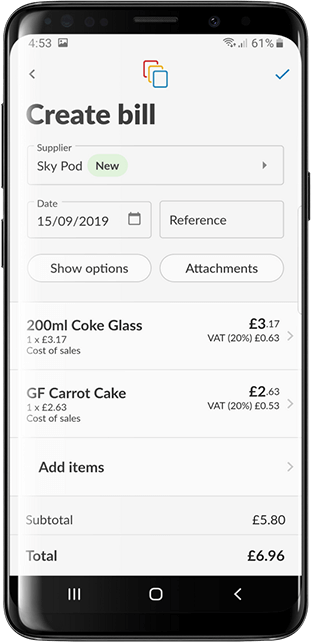

Use Clear Books CIS software to record the invoices you receive from subcontractors. These are bills for you to pay.

The Clear Books clever CIS subcontractor verification tool will check each subcontractor's CIS deduction rate with HMRC and automatically calculate the CIS deduction you should withhold.

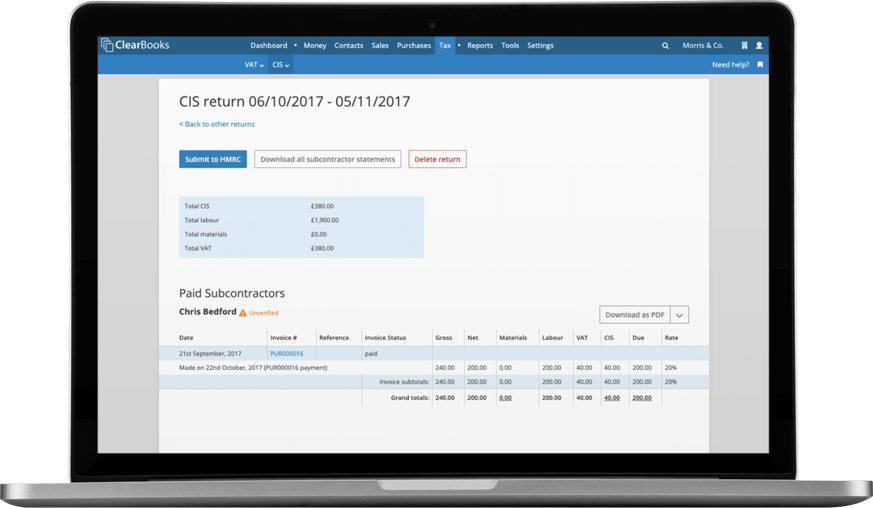

Clear Books' CIS software automatically pre-fills CIS returns for HMRC using the subcontractor invoices you track each month.

You can submit the return directly to HMRC through Clear Books.

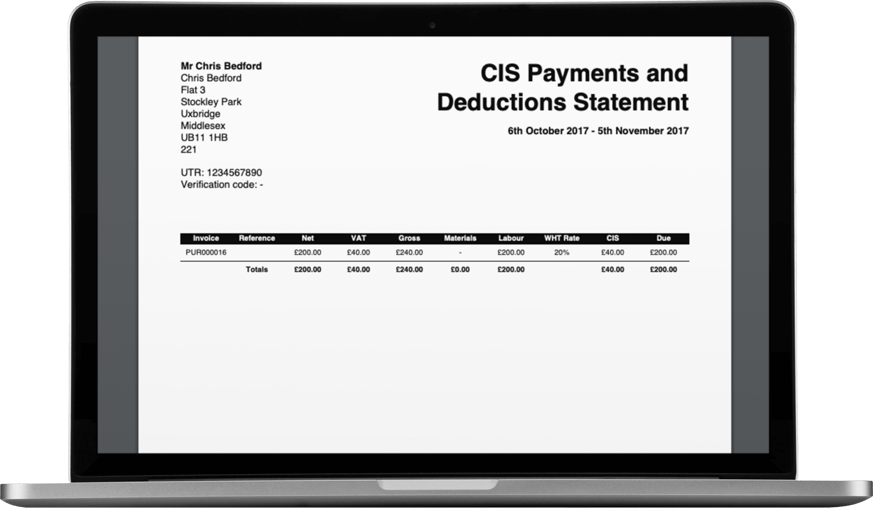

Clear Books automatically creates monthly payment and deduction statements for each of your subcontractors.

Download or email them directly to subcontractors from Clear Books' CIS software.

And, if you need to run a CIS payment and deduction statement for a group of subcontractors at the same time (or for a custom time period), Clear Books can create that report as well.

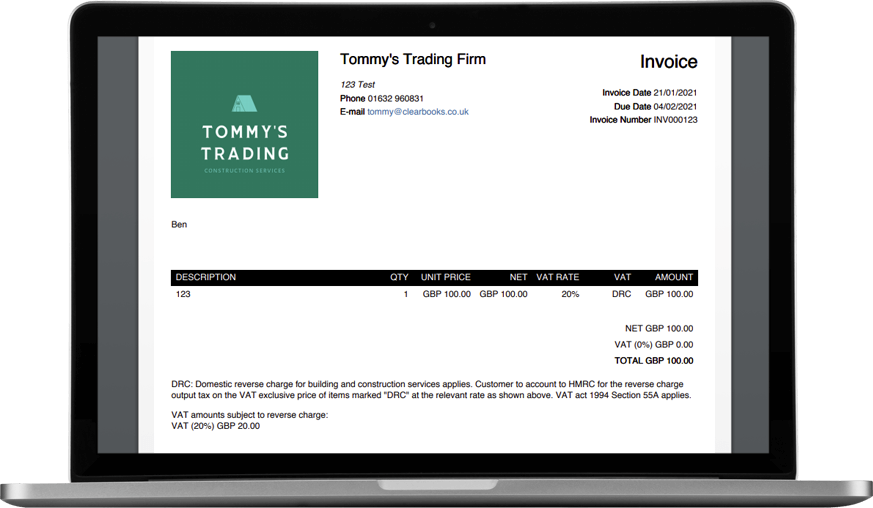

Clear Books has the option for you to apply VAT DRC to your invoice or bill. You’ll be HMRC compliant and ready for the taxman.

Try these great features to make accounting easy for your small business:

Keep track of your receipts & bills by snapping photos of them with our app. We extract information from the picture and automatically create a purchase record for you so you won't lose another receipt.

We'll automatically create a quarterly VAT return for you to view, edit and submit directly to HMRC.

Clear Books' project reporting gives you full visibility of your profit by project. Assign each invoice, receipt or bill to a project (e.g. that loft conversion you're currently working on). Clear Books will automatically produce a report so you can see what you've made and what you've spent on the project. It's a great way to see how profitable you are on each of your projects.

Clear Books' online payroll & HR makes it easy to calculate pay, produce payslips, track employee absences and report to HMRC.

HMRC have special rules for tax in the construction industry. Known as the Construction Industry Scheme (CIS), these rules require construction contractors to withhold tax for the subcontractors they hire to work on a project (either 20% or 30%) when they make a payment to a subcontractor for work they've completed. When the subcontractor then completes their tax return at the end of the year, they should have a £0 income tax bill.

You can verify subcontractors are registered for CIS using Clear Books accounting software or the HMRC website. The verification tool will show you what rate of deduction to use or if you can pay them without making deductions.

Select the CIS deduction rate for your subcontractors when entering their invoices into Clear Books. The CIS accounting software will automatically calculate how much CIS you should withhold.

CIS accounting software will automatically calculate the CIS you should withhold for contractors when you enter the invoices they provide to you. At the end of the month, you will see their total deductions listed on a CIS payment and deduction statement. You should email these statements to your contractors.

An excellent program

The support is really good. I have been using this now for years and every time I have experienced any problems they have gone to great lengths to help to resolve it.

It is a program that can be tailored to most industries especially good for the construction industry with a comprehensive CIS module incorporated in it at no extra charge. Would highly recommend it to anyone.

Clear Books, accredited by The Institute of Certified Bookkeepers and registered with the Financial Conduct Authority (reg. no. 843585), delivers valued, comprehensive online accounting software for small businesses in the UK.