Tag: Making Tax Digital

Government announces changes to timeframe for Making Tax Digital for Income Tax Self Assessment

Making Tax Digital ITSA will be delayed by two years, becoming mandatory from April 2026. The new timeframes set out a phased mandation, allowing those with lower incomes more time to prepare.

Making Tax Digital for Income Tax Self Assessment (MTD ITSA) FAQs

Making Tax Digital for Income Tax Self Assessment (MTD ITSA) is coming, and Clear Books is here to help you prepare for the changes. If your business is VAT registered, you will already be familiar with MTD, the government’s initiative...

Why it pays to be a VAT registered business

VAT registration: for many business owners it feels like a “someday” thing. It’s something you’ll take care of way down the line, when you’re closer to the threshold for registration, when you have more staff, when your business is bigger,...

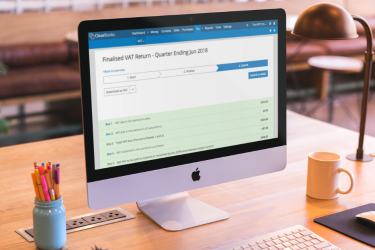

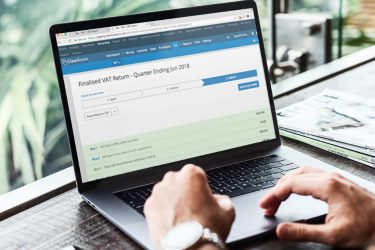

Making Tax Digital for VAT: Your Questions Answered

MTD VAT is coming – is your business ready? Soon all VAT-registered businesses will need to submit their VAT returns electronically to HMRC. Whilst the thought of changing your processes to comply with MTD VAT may seem daunting, it can...

Self Assessment: HMRC waives fines for late filings

With 2021 now well and truly behind us, the self-employed and accountants across the country will be turning their attention to the looming Self Assessment Income Tax deadline on 31 January. Those struggling to file their tax return by the...

The latest on MTD ITSA: Making the most of the delays

It would be fair to say that the rollout of Making Tax Digital, the UK government’s initiative to digitise record keeping and increase reporting for businesses in the UK has been a gradual process. It had to be: MTD signals...