Accountants – join Clear Books for Christmas drinks!

On Thursday 4th December, Clear Books Pro will be hosting the Christmas instalment of Tick and Bash and we’d love to see plenty of accountants and bookkeepers there! Tick and Bash is a quarterly social event hosted by Clear Books which...

Clear Books is Client Software Product of the Year!

We’re thrilled to announce that Clear Books has been named Client Software Product of the Year at the British Accountancy Awards. The awards, which are run by Accountancy Age, celebrate excellence in the accountancy profession and aim to recognise...

Clear Books named as a Smarta 100 company

We received a nice surprise in the post this week - a certificate confirming Clear Books' place in the Smarta 100 list. The O2 Smarta 100 is an annual celebration of the most resourceful, inspiring and disruptive small businesses in...

Make new connections at our December networking event

We’re holding the latest Clear Books Community networking event on 3rd December, and we’d love to see you there! The free event is aimed at UK small businesses and is a great opportunity to meet and network with other small...

Save even more time with Clear Books

We recently surveyed our community of accountants to ask what tips they use to save time and get more done. Read what they had to say here: [slideshare id=41849137&doc=time-saving-141121050946-conversion-gate01] There are also lots of other helpful guides and...

CBCE: Meet our first ticket holder!

You may have heard that on 6th February 2015 Clear Books will be holding it’s first Community Exhibition in London. Tickets went on sale earlier this week, both to attend the event and also to exhibit your business to attendees, and...

Clear Books Community Exhibition is coming!

We’re excited to announce that Clear Books’ first ever Community Exhibition, supported by Microsoft, will be held on 6th February 2015 at Microsoft’s central London offices. The programme for the one day event is based on feedback from our community...

What’s your perfect winter workspace environment?

We've been having a bit of a battle with the office temperature at Clear Books this week as the weather fluctuates between tropical sunshine and freezing downpours. But despite the hottest Halloween on record we can’t deny that after Bonfire...

‘Hugs’ of the month – October

Each week, the Clear Books team sets aside some time to work on what we call ‘customer hugs’ - work that focuses solely on improving the way a feature works, or creating an entirely new feature to make your life...

Top 10 scariest workplaces

It’s Halloween! And in honour of the scariest day of the year we’ve compiled a list of the world’s most terrifying places to work. After reading these we’ll never be frightened of Monday morning meetings again... 1. Above the...

Did you know…? With John Fouracre

Who are you? Hi, I’m John and the support team leader at Clear Books. What does your role at Clear Books entail? I help the support team with any questions they need assistance with, and make sure they are all...

Nicholas Sanders’ week at Clear Books

My name is Nicholas Sanders and I have spent a week at Clear Books doing work experience. I’m 17 years old and in my second year of A-levels. I wanted to do my work experience at Clear Books as I...

Clear Books is now an ACCA Approved Employer!

Clear Books is now certified by the ACCA as a Gold Level Approved Training Centre! ACCA is one of the largest global accounting bodies under IFAC with over 170,000 qualified accounting members and more than 400,000 student trainees across 180...

Open Payroll and RTI

RTI (Real Time Information) is a method of reporting payroll information to HMRC that became compulsory for most employers in April 2013. As you may be aware, larger businesses using the PAYE scheme can now be charged RTI fines. Smaller...

It’s awards season at Clear Books!

Clear Books had a nice surprise in the post today as we received a certificate confirming us as a finalist in the Cloud Provider Innovation of the Year category at the 2014 UK IT Industry Awards. The winner will be...

Find out what tax relief and incentives your business is eligible for

As a UK business owner, you will be well aware of the variety of taxes you need to pay. However, depending on the criteria of your business you might also be eligible for certain tax relief or assistance with business...

Use Clear Books event space for free!

If you’re a Clear Books customer, we’re offering you the chance to use our newly refurbished events/ training centre in November completely free of charge! When we moved in to our new office earlier this year, we decided to retain...

VAT comparison user guide

We recently added a fantastic new feature to Clear Books Accounts, enabling users to compare VAT liabilities under standard VAT and the Flat Rate Scheme (FRS). We’ve now added a comprehensive guide to using this feature - click here to...

How cloud accounting software is changing the business model of accounting firms

As a cloud software provider, we often communicate the benefits of cloud technology in making your business more efficient, automated and flexible. However, cloud technology, and cloud accounting software such as Clear Books Accounts, has also opened up a variety...

Clear Books Accounting – the new name for our cloud accounting software

You may have noticed that on our new website, we’ve slightly adjusted the names of our applications. We wanted to make sure all customers were clear on which name refers to each app. When we started out as a company, we...

Clear Books to go Dutch

Clear Books is set to expand internationally by opening our first subsidiary in the Netherlands. Until now, Clear Books has focused exclusively on building our UK customer base and increasing our share of the UK cloud software market. With this move, business owners in...

Find out what our customers love about Clear Books

Many of our business users may well have attended one of our frequent Community networking events, giving small business owners a chance to learn more about Clear Books and network with others. At a recent Community event, we spoke to...

Vote for Clear Books!

We’re delighted to have been named in the 02 Smarta 100 list, recognising Clear Books as one of the most resourceful, original, exciting and disruptive small businesses in the UK. We've also been nominated in a specific category - Best...

Feature updates – September 2014

Clear Books is constantly evolving and developing, much of which is down to the feedback from the Clear Books Community with many users letting us know what they'd like to see added to our software. In order to keep you...

Welcome to the new Clear Books website

If you’re reading this blog, hopefully you'll have noticed that we’ve revamped the Clear Books website! As well as having a visual makeover, we hope you find using the new site a much nicer experience. The major improvements this new site brings...

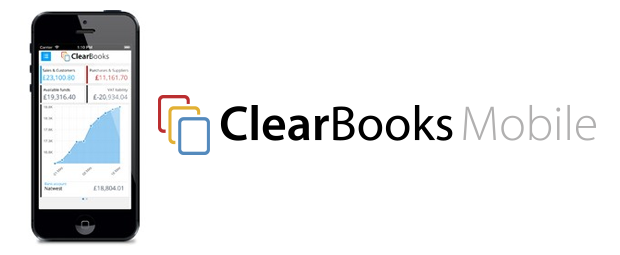

Take a look at the Clear Books Mobile app

We wanted to let our customers know about a great feature that has recently been added to the Clear Books Mobile app. When creating expenses on the app, you can now take a photo of a receipt or bill on...

We’ve been shortlisted at the Nimbus Ninety IGNITE Awards

We are excited to announce that Clear Books has been shortlisted as a finalist in the 2014 Nimbus Ninety IGNITE Awards in the category of 'Disruptive Start-Up' company. Nimbus Ninety describe this specific award as 'celebrating the digital start-ups who are...

Did you know…? With Vanish Patel

Who are you? Hi, I’m Vanish and I’m a customer support analyst at Clear Books. What does your role at Clear Books entail? Being a customer support analyst involves various types of problem solving for different customers. This includes the...

Case study: Metric Accountants

We sat down with one of our accounting partners, Katrine L Richardson from Metric Accountants, to find out what it is she likes about cloud accounting and Clear Books. My name is Katrine, I am one of the directors and founders...

Introducing our new VAT comparison feature

Clear Books has created a new feature to enable users to make comparisons between standard VAT (in which VAT is based on the difference between VAT charged to customers and VAT paid on purchases) and the Flat Rate Scheme (FRS)...