The government has announced that the full implementation of Making Tax Digital will be delayed by ‘at least’ two years (until 2020), although quarterly VAT reporting using digital systems will be mandatory from 2019.

The original timetable for the rollout of making tax digital meant that businesses, self-employed people, and landlords would have been required to start using the new digital tax service from April 2018 for income tax and National Insurance contribution (NICs) purposes if turnover was over the VAT threshold (currently set at £85,000).

The change means that full-scale quarterly reporting to HMRC through their digital service won’t be implemented until 2020:

However, businesses with a turnover above the VAT threshold (£85,000) will have to keep digital records for VAT purposes from April 2019

Why the change?

HMRC say they are still committed to digitising tax, but have delayed the rollout because they recognise that businesses, particularly micro businesses need time to adapt. HMRC also need more time to solidify the process and pilot their systems in order to ensure the transition to “digital only” tax submissions goes smoothly.

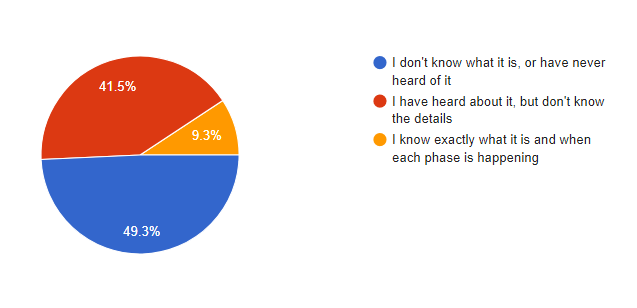

When research shows that 65% of businesses aren’t ready for MTD and furthermore, only 9.5% of Clear Books customers have a full understanding of MTD and know the timetable for the rollout, it’s clear that HMRC have had difficulty communicating their plans to the small businesses community.

Survey to Clear Books customers: How aware is your business of MTD?

What does this mean?

Although many small businesses and accountants welcome the delay, the bottom line is, MTD is still going to happen. The delay will give small businesses and accountants time to adjust, but businesses shouldn’t put it completely to the back burner as 2019 is not far away.

If businesses and accountants ignore HMRC’s plans for MTD and allow the secondary deadline to creep up on them, they my find themselves in a similar position in 2020 as they are today, not knowing the details behind MTD and rushing to implement systems to comply with the new regulations.

There’s no time like the present

With the announcement of this new grace period, small businesses and accountants should start to future proof their businesses for MTD. Clear Books has been working with HMRC for some time and we have a number of ways we can help businesses easily move into the age of digital tax.

Clear Books Micro

Clear Books Micro provides smaller businesses with the means to record sales invoices, purchases and expenses within an easy-to-use online spreadsheet and make this data available to their accountants. Using Clear Books Micro regularly to record accounting data will help avoid losing essential paperwork and ease the burden on accountants, especially at Year End. Clear Books Micro is FREE to the end user.

Clear Books Practice Edition

Clear Books Practice Edition is a fully functioning version of the established Clear Books cloud accounting software, but it will only be available to and accessed by accountants. Data from Clear Books Micro can be uploaded into Clear Books Practice Edition, enabling the accountant (who, after all is best placed to provide professional advice to small businesses), to make any necessary adjustments before making online VAT and MTD submissions to HMRC on behalf of their client.

Clear Books Cash Book

For smaller businesses who wish to make a first step into cloud accounting, Clear Books Cash Book provides a simple way of managing their accounts by only recording the cash received and cash spent in running the business. Clear Books Cash Book will enable the user to make online VAT and MTD submissions to HMRC.

If you’re an accountant or a small businesses, we’re here to help. Give us a call on 0800 862 0202 or email sales@clearbooks.co.uk to discuss your needs.