Regular visitors to the Clear Books Network will be aware of the suggestion of a mileage tool, which was submitted by Mohamed Aly.

This idea is currently the most popular feature request, with a whopping 64 votes and 11 comments. We love this idea so much that we have decided to make it a reality. The 11 comments from all of you proactive Clear Books customers have provided us with vital information about what you want from the tool.

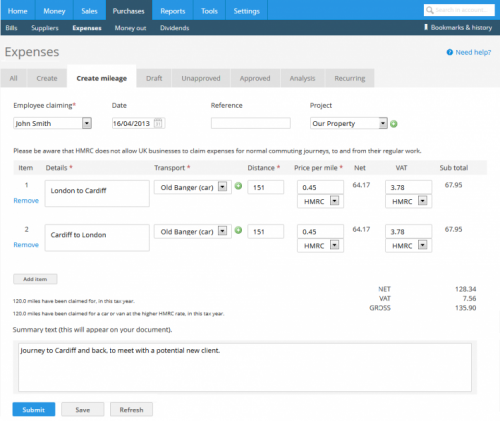

This new feature will make it miles easier (no pun intended) for you and your employees to claim back expenses for work related journeys. All you need to do is enter your vehicle details and number of miles you wish to claim and let Clear Books do the rest.

HMRC allows expense claims to be made for journeys that are not part of claimers commute to and from their regular place of work. These journeys have to be made in the claimers personal vehicle. Vehicle types includes: cars, vans, motorcycles and bicycles.

The mileage tool works to HMRC guidelines, so you can rest assured knowing that mileage claims will only amount to what HMRC allows and they will include VAT.

Clear Books will also keep a log of the total number of miles claimed, as HMRC currently allows the first 10,000 car/van miles to be claimed at 45p per mile and then 25p per mile for every mile after that. Don’t worry about that though – the mileage tool takes care of making sure that claims are always paid out at the correct rate.

If you don’t wish to use HMRC rates you can set the tool to manual and this will allow you to enter your own figures and rates.

Please let us know what you think of the mileage tool. Your feedback is what makes Clear Books great!