The new tax year brought about a very welcome change, originally announced in the March 2013 budget.

Most employers will now benefit from a £2,000 reduction in the National Insurance contributions (NIC) they are billed for. This reduction relates to the first £2,000 of employers NIC the employer is charged – for example, if the employer would normally pay monthly employers NIC of £600, the first 4 tax months would benefit from a reduced bill.

To find out if you are eligible you can read some guidance written jointly by HM Revenue & Customs and HM Treasury:

https://www.gov.uk/employment-allowance-up-to-2000-off-your-class-1-nics

Open Payroll helps employers to claim this allowance by providing some helpful hints and tips. Once you are sure you are eligible for the reduction sign in to Open Payroll, navigate Employer — Details, and check the relevant tickbox.

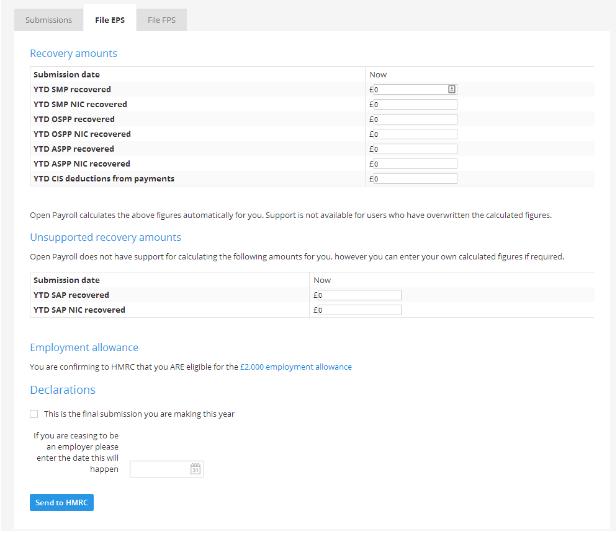

Once you have done so, HMRC will need to be informed that you are taking advantage of this scheme so they can reduce your bill. This process is simple and can be done by making an EPS submission. An example of this is shown below.

Hello Jodie,

The system will do this and put the CIS deductions on the RTI EPS submission automatically.

Vanish