Clear Books partner accountant Michael Godsmark of Woodville Accountancy looks at the steps you need to take as an employer to be ready for auto enrolment.

What is it?

Auto enrolment is essentially a government pension scheme which is administered and run by employers. The government’s aim is to try to ensure people have enough saved up to last them through retirement.

When is it happening?

Auto enrolment is now in place for all employers with more than 30 employees. Also now being registered are smaller employers who have relevant PAYE reference numbers.

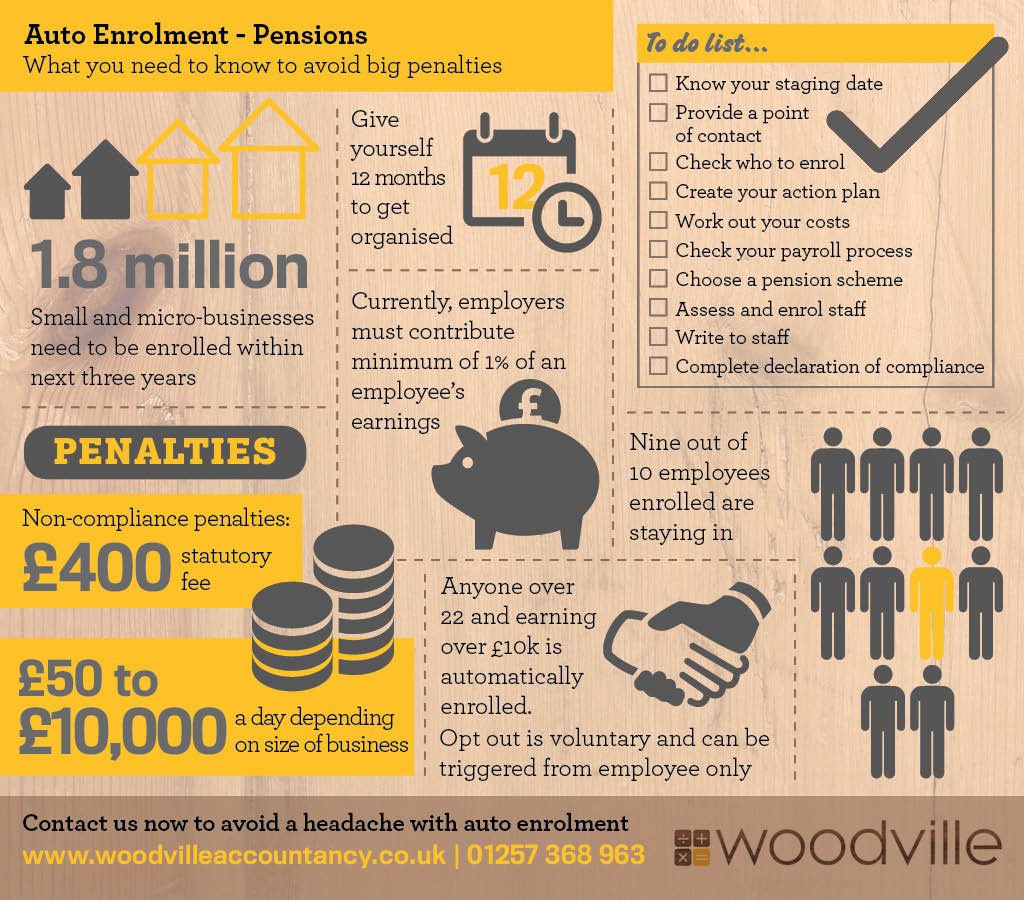

The vast majority of the smallest employers (which is the majority of employers in terms of numbers – up to 1.8 million) are yet to be caught by auto enrolment, but they will need to have a workplace pension set up extremely soon to avoid the onerous penalties for non-compliance.

I’m an employer, and don’t know what to do!

The letters have been sent out, TV and radio adverts are broadcasting and posters are plastered everywhere from bus stops to buildings. But if you’re still unsure on what you need to do next as an employer, here’s a quick guide to get you started:

1. Find out your staging date

If you’ve not received or can’t find your letter, head to the pension regulator website to find out your date here.

2. Assess your existing scheme

If you already have a workplace pension in place, find out if it’s compliant with auto enrolment legislation. If you don’t have a scheme in place, you need to start looking. The likes of NEST, Now and The People’s Pension all have easy interfaces and set up guides to help you on your way.

3. Check your payroll software

Your payroll software should be able to link with the pension provider you use. Picking the right software provider here could save you rafts of time in the future. Find out what Clear Books Payroll has been doing to help you comply with auto enrolment here.

4. Assess your staff

See which of your staff are eligible, then write to let them know of their status and eligibility.

5. Start on your staging date

Your staging date is the date you need to start the scheme. Make sure you start by then or big penalties apply!

Get planning now to save yourself an auto enrolment headache!

Our team at Woodville Accountancy have produced this handy infographic to help you even further with auto enrolment.